Resources

Users may assign an “Alternate” (Preparer, Examiner, or Approver) in the Recon@UVA system to facilitate reconciliation. Alternates must be knowledgeable of the relevant policies, procedures, and guidelines for reconciling departmental records. The assignment of an alternate does not alleviate the fiscal responsibility of the Person of Record.

NOTE: Reconcilers can only assign an alternate role for the position in which they are listed as the Person of Record. In other words, a Preparer will only be able to assign an Alternate Preparer and cannot assign an Alternate Approver on their

As you are working on reconciling the revenue in the General Ledger, it can be helpful to know some background information about the General Ledger and Depositing. If you aren't the person who processes the revenue and you haven't completed the GL - Working in the General Ledger class in Workday Learning, I recommend that you complete that training. It will help you better understand the information of the reports you will be reviewing as part of the GL reconciliation process.

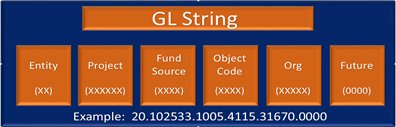

- GL String

-

Entity

The GL String's Entity segment is the balancing segment in

- What documentation am I required to keep?

-

Reconcilers must retain all supporting documentation related to financial transactions.

Note: Signed and dated packing slips should be maintained when appropriate.

Exceptions:

- Petty Cash - original documentation is forwarded to central offices.

- Transactions in ExpenseUVA - unless required by a grant.

- If a document resides electronically in the Integrated System, reconcilers are not required to print it.

- Are documentation requirements different based the sponsor?

-

If you have questions regarding documentation requirements for

How can I remove Planned Expenses from my reconciliations?

- In most cases, an outstanding planned expense is either a Purchase Order (PO) that needs to be finally-closed or a Purchase Requisition that needs to be canceled.

- Finally-closing a PO: See this job aid.

- Canceling a Requisition: See this job aid.

-

If you need more information related to POs/Purchasing planned expenses, please see the Procurement Training Guide: https://foc.virginia.edu/training-guides

- What is the difference between a comment, an issue, and a reconciling item?

-

- Comments are similar to sticky notes, or notes you would write in the margin of a report to provide additional information to reconcilers. They can be entered at a BBA Summary, Budget Category, or Detail level.

- Issues are comments entered at the Detail level indicating that the item needs follow-up. An issue remains active until it is resolved or closed.

- Reconciling Items are a dollar value entered at the BBA or Budget Category level to increase or decrease the budget balance available to account for future

- How do I assign an Alternate in Recon@UVA?

-

Visit our Assigning an Alternate webpage for step-by-step instructions on completing this process in Recon@UVA.

- Can all roles utilize the Alternate feature in Recon@UVA?

-

Yes, all 3 roles in the reconciliation workflow (Preparer, Examiner, and Approver) can assign an Alternate.

- The assignment of an Alternate does not alleviate the fiscal responsibility of the Person of Record.

- How do I know if I am an Alternate or the Person of Record?

-

The descriptive information in the header (once the view details folder icon has been clicked) lists

- What is a "Role" in Recon@UVA?

-

In Recon@UVA, roles are used to restrict users' access to data and identify one's position in the reconciliation workflow. For each project, the following roles are used:

-

Preparer: The person responsible for the detailed reconciliation, including maintenance of source documents to verify all transactions are legitimate. This role is known as the “Fiscal Contact” in the Integrated System and is a required role in the Recon@UVA system.

-

Examiner: The person responsible for examining and verifying the work of the Preparer prior to final approval.

-

- What do I need to do as an Approver?

-

-

Once your reconciliations have been prepared and/or examined, log on to Recon@UVA.

-

Review the work of the Preparers and/or Examiners.

-

Review issues, record comments, and request corrections as appropriate.

-

Update reconciling items as appropriate.

-

Certify and approve the reconciliation. This step records the Approver’s signature and date. If changes are required, return to the Preparer for rework.

-

- Can I approve an account when Issues have been identified?

-

Yes. When you electronically sign your report what you

- What do the icons mean?

- What do the "Actions" icons help me do?

-

- View detail

- Add a comment

- Enter a reconciling item

- Send forward/backward

- View Labor Distribution report

- Print Budget Balance Available report

- How can I keep my NetBadge from timing out?

-

Users should refresh their screen periodically to ensure their connection is renewed. If you will not be working in the system for a period of time (for instance, an hour or more), it is recommended that you close your internet session and start a new connection

- What is Recon@UVA?

-

Recon@UVA is the University’s official reconciliation system of record that provides an electronic solution for the documentation of reconciliations for all organizational units at the University of Virginia (including all academic schools and departments).

- Am I required to use Recon@UVA

-

Yes, use of the system is mandatory in order to electronically document the review and approval of each Project-Award combination.

- Do I have to print and/or sign reports?

-

No printing or signing is required. All reconciler signatures are captured electronically and reports

- What is a Budget Balance Available (BBA) Report?

-

A calculation of the budgeted amount minus expenditures and commitments/encumbrances. Note that this will be based on either a project to date or year to date budget, and does not refer to the amount of cash on hand.

- Can I view a BBA report in Recon@UVA?

-

Budget Balance Available (BBA) Reports are accessed from the Summary Screen by clicking the printer icon under the associated "Actions" for the Project-Award combination:

- Are BBA reports only available in Recon@UVA?

-

No, this information can also be

- Why is reconciling labor important?

-

Labor expenditures make up greater than 60% of the University’s total expenses each fiscal year. Therefore the careful review of labor expenses as part of the monthly reconciliation process is critical to sound financial stewardship and is part of our system of internal controls. A manager’s timely review and approval of any compensation action, including timesheets, is a key control on labor expenses; however, that does not negate the importance of monthly reconciliation to ensure that labor expenses are appropriately allocated. In addition, monthly

Board of Visitors Policies*

- Debt Policy (pdf)

- Interest Rate Risk Management Policy (pdf)

- Working Capital Investment Policy

- Liquidity Management Policy

Treasury Policies*

- Receiving and Depositing Cash & Select Monetary Instruments

- Establishing and Managing Bank, ATMs, and Other Financial Institutional Accounts for University Funds

- Internal Borrowing Program

- Internal Investment Program for University Units

- Monitoring Cash Balances and Resolving Deficits in Projects

- Tax-Exempt Debt Compliance

- Managing Petty Checking Accounts

- Managing Petty Cash Funds

- Managing Change Fund

- Electron

The Office of the Treasurer is the steward of the University’s financial resources, practicing sound financial management in support of academic, scientific and faculty excellence. Reporting directly to the Vice President for Finance, the Treasurer’s office ensures the sustainability of the University’s mission and goals by:

Mission and Vision

We focus on forging strong relationships, managing capital, and mitigating risk with the goal of enabling the University’s aspirations, minimizing financial distraction, and providing peace of mind to our customers.

Values

- Trust - Show

Protecting the University against financial loss from property and liability risk exposures through the implementation of various risk management techniques.

Services

- Risk Financing - Maintain numerous insurance and self-insurance programs to protect the University and the University community against property and liability losses on Grounds and worldwide

- Claims Management - Manage all property and liability claims that occur on University Grounds or arise from University operations worldwide—includes subrogation against third parties causing damage to University property

- Loss

Treasury Management manages the short-term investment of the University's working capital and oversees its long-term investments with the University of Virginia Investment Management Company (UVIMCO). The short-term investments are managed to provide the University with sufficient liquidity and safety for operating cash. Long-term investments are invested according to the guidelines in UVIMCO's Investment Policy statement.

Treasury also provides oversight of investments held outside UVIMCO, such as trusts and security-specific investments.

What is a wire?

Wire transfers are a form of payment whereby funds are sent through the Federal Reserve Wire Network from one financial institution to another.

When should wires be submitted?

Wire transfers should only be requested when payments cannot be made with the Purchasing Card or any other standard University form of payment.

What is the cost?

Outgoing wire transfers are the University's most expensive payment option and are therefore processed only upon request. The internal costs associated with wire transfers are absorbed entirely by the University and are not passed on to