Resources

What should I do if there is a deficit in my Cash Balance?

-

If you are the Preparer - bring the deficit to the Approver's attention.

-

If you are the Approver - make arrangements to resolve the deficit.

How do I request an authorized cash deficit?

- Requests for cash deficit authorizations must be made in writing to the Treasurer and must be signed by the appropriate Dean or Vice President. Authorization(s) for cash deficits will be granted, in writing, by the Treasurer.

How do I certify if a report doesn't pull in the GL Details Recon module?

- If a report doesn't pull, this means your project had no current period activity, however, you must review the project's GL Cash Balance. In order to certify, you must print the GL Cash Balance Summary. The Preparer and the Approver should sign and date the printed GL Cash Balance Summary report.

What documentation am I required to keep?

- Departments and activities must maintain files that are sufficient to support the accuracy and completeness of data entered into the financial modules of the University’s

Who is the GL Approver the Project Approver or the Project Manager?

- Either - The unit can chose either the Project Approver or the Project Manager to approve the GL reconciliations. However, if the Project Manager is also the Fiscal Contact then the Project Approver will have to approve the GL Reconciliation.

How can I be assigned as a Preparer or Approver?

- In order to be the Preparer or Approver of record, you must be listed as a Key Member in the Integrated System, specifically the Fiscal Contact (Preparer) or the Project Approver/Project Manager (Approver). If you need to make

What access do I need to reconcile GL projects?

- You will need access to UBI to complete the General Ledger reconciliation procedure. If you do not already have access to the finance modules in UBI, you can find more information on their website's Get Started section.

What reports are we required to review?

- GL Cash Balance Summary

- GL Details Recon

*See the GL Reconciliation Procedure for detailed instructions on how to find these reports

THE VICE PRESIDENT FOR FINANCE LEADS THE FOLLOWING REPORTING UNITS:

- Financial Operations, composed of

- Finance Outreach & Compliance

- Financial Planning & Analysis

- Office of the Treasurer, composed of

FAQs regarding COVID-19 and Financial Operations

Please review the following details of UVA Finance operations regarding COVID-19.

Refer to UVA's Comprehensive information regarding the coronavirus and the University's operational state: https://coronavirus.virginia.edu/

Accounts Receivable

- Has UVA made any changes to its debt collection policies while operations are disrupted?

-

A: All operations continue as normal while UVA employees are working remotely, including collection of outstanding debts. However, the University understands that these are stressful times. If you would

ARMICS is an initiative of the Department of Accounts (DOA) for all state agencies within the Commonwealth of Virginia. The primary purpose of ARMICS is to ensure fiscal accountability and safeguard the Commonwealth's assets.

The goal is to provide reasonable assurance of the integrity of all fiscal processes related to:

- Submission of transactions to the Commonwealth's general ledger

- Submission of deliverables required by financial statement directives

- Compliance with laws and regulations

- Stewardship over and safeguarding the Commonwealth's assets

Mila Demchynk Savage

Recon@UVA System Administrator

Danielle Hancock

Reconciliation Training Administrator

Stewart Craig

Functional Administrator for Sponsored Projects

Augie Maurelli

Functional Administrator for Non-Sponsored Projects

Gift cards must be purchased either through the UVA Marketplace or using a Travel and Expense Card. University employees are not allowed to purchase gift cards with personal funds and seek reimbursement. Gift cards are taxable at any amount. Please use expense tile Gifts Non-Employee or Employee Award Taxable (whichever is appropriate) no matter the amount of the gift card. For Medical Center Employees who are being reimbursed, please use expenditure type Gifts Non-Employee.

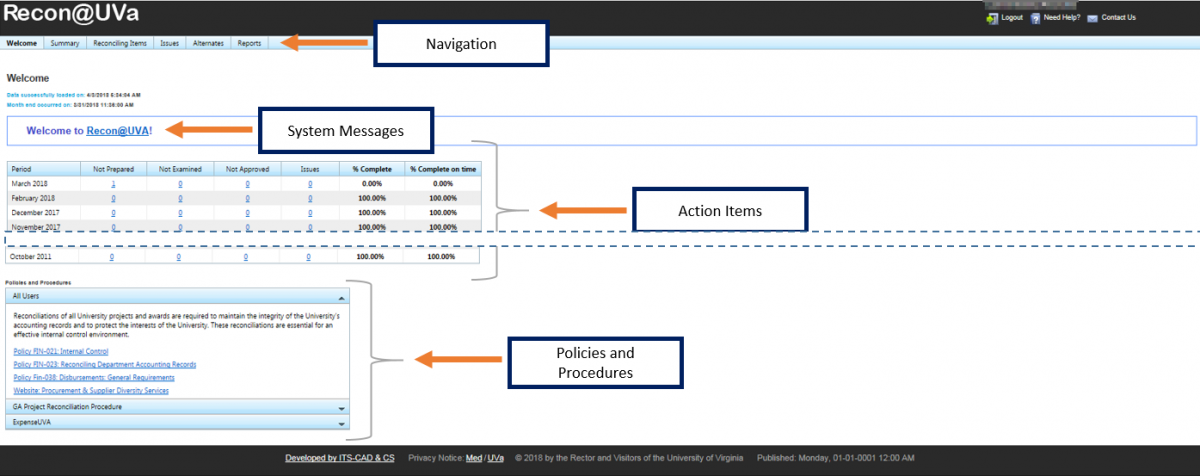

- Welcome Screen

-

Welcome Screen

The Welcome Screen is displayed when you login to Recon@UVA. At your initial login (and annually after that), you will be asked to certify your compliance with the policies, procedures, and guidelines governing the reconciliation process.

Navigation

- The Navigation Bar displays a tab for each area in Recon@UVA that you are authorized to access. Click on the tab to navigate to the desired section.

- For information regarding the "Reconciling Items" or "Issues" tabs, visit their corresponding section on the Recon@UVA

- The Navigation Bar displays a tab for each area in Recon@UVA that you are authorized to access. Click on the tab to navigate to the desired section.

Preparer

The Preparer is responsible for reviewing each transaction (deposit or transfer journal entry) posted to a GL account string in the University’s Integrated System to ensure its accuracy, and to ensure that sufficient source documentation is available.

The Integrated System Role, Fiscal Contact, is the Preparer of Record.

Approver

The Approver is responsible for verifying the legitimacy, appropriateness, and necessity of transactions recorded in the GL module of the University’s Integrated System.

The Integrated System role, Project Approver or Project Manager, is the Approver

Users may assign an “Alternate” (Preparer, Examiner, or Approver) in the Recon@UVA system to facilitate reconciliation. Alternates must be knowledgeable of the relevant policies, procedures, and guidelines for reconciling departmental records. The assignment of an alternate does not alleviate the fiscal responsibility of the Person of Record.

NOTE: Reconcilers can only assign an alternate role for the position in which they are listed as the Person of Record. In other words, a Preparer will only be able to assign an Alternate Preparer and cannot assign an Alternate Approver on their

As you are working on reconciling the revenue in the General Ledger, it can be helpful to know some background information about the General Ledger and Depositing. If you aren't the person who processes the revenue and you haven't completed the GL - Working in the General Ledger class in Workday Learning, I recommend that you complete that training. It will help you better understand the information of the reports you will be reviewing as part of the GL reconciliation process.

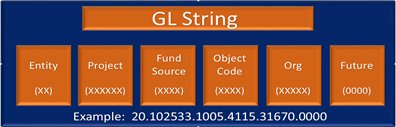

- GL String

-

Entity

The GL String's Entity segment is the balancing segment in

See a full listing of Award Prefixes here: https://fro.vpfinance.virginia.edu/processing/all

See a full listing of School / Unit Prefixes here: Fiscal Officer Resource

| Acronym | Meaning |

|---|---|

|

AP |

|

|

AR |

|

|

BBA |

Budget Balance Available |

|

BCS |

|

|

CC |

Credit Card |

|

ESHARP |

|

|

ETF |

|

|

EVA |